Let’s pivot to a slightly different geography: the United Kingdom. The phrase “buy bank account comparison UK” might sound odd (since one doesn’t literally buy a bank account), but what it implies is researching and selecting a bank account in the UK by comparing offers—and essentially “buying into” the one that best serves your needs.

What to compare when opening a UK bank account

-

Monthly fees or maintenance charges — some “premium” current accounts in the UK carry fees (e.g., for added perks).

-

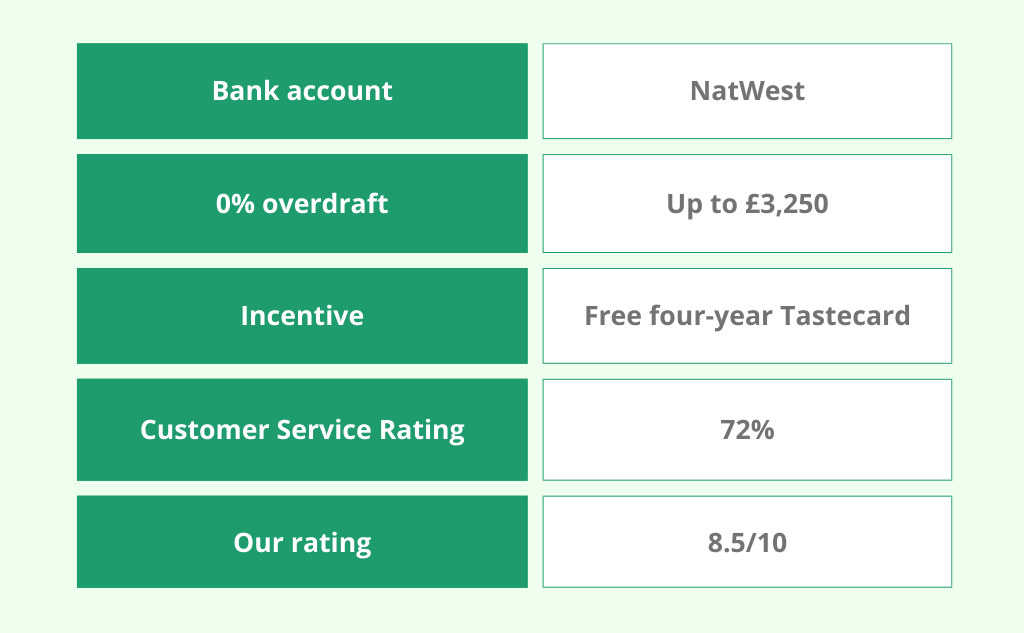

Overdraft terms (for students or others) — how much overdrawn you can go, and at what cost. Luxury Student Homes

-

Rewards and perks — recent offers include cash bonuses, free railcards or other incentives for students. The Guardian

-

Mobile and online banking features — how good is the app, how convenient are transactions, and does it fit your lifestyle (especially if you’re a traveler, student or expat).

-

International/foreign use — if you travel or study abroad, choose an account with minimal foreign-transaction fees or good ATM access. Resources for global banks mention this as important. NerdWallet

-

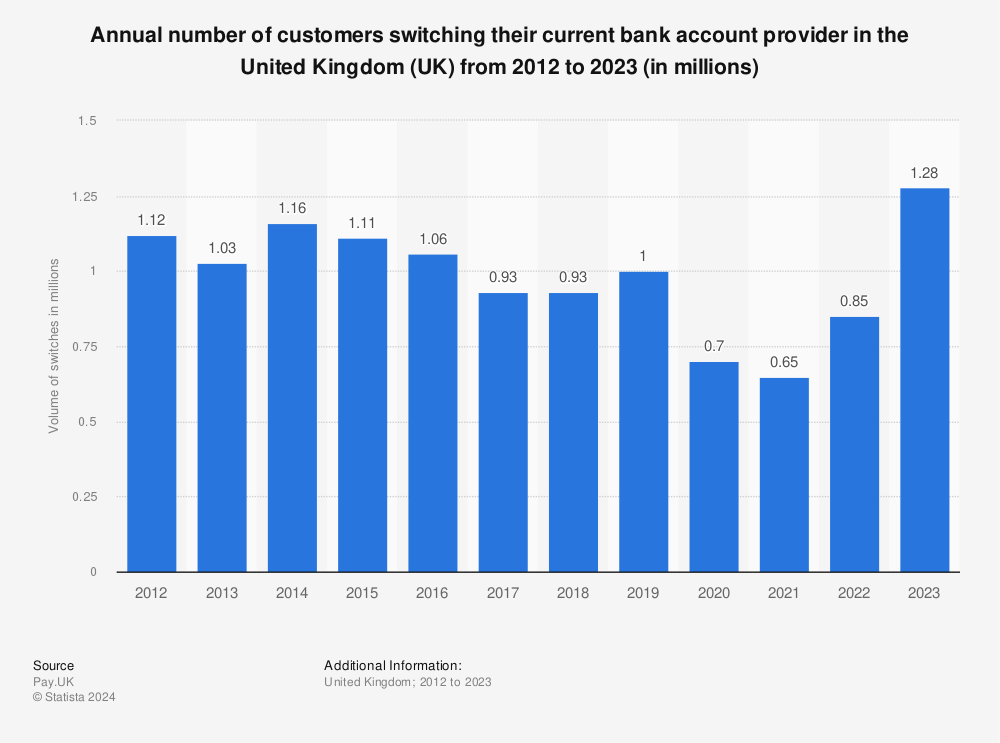

Switching ease — in the UK there’s the Current Account Switch Service (CASS) that helps with moving accounts; consider how straightforward it is.

Why use a comparison approach

Just like checking personal loans in the USA, you want to do a “ranking” or comparison of accounts in the UK. There are many offers available, and some sound great but may carry hidden costs (for example high overdraft rates, or conditions on the incentives). The best-practice is to list your priorities, review at least 3–5 accounts, and select the one that fits.

Final thought

Whether you’re a UK resident, a student, or an international traveler seeking a UK account, performing a bank account comparison UK-style helps you make an informed choice. Think of it as “buying” the best bank account for you by choosing with clarity rather than convenience alone.