Finally, for those who travel regularly (domestically or internationally), the phrase “best travel credit cards USA” is a compelling search term. It refers to credit cards offered in the United States that provide outstanding travel rewards, perks, flexibility and value.

What makes a travel credit card among the “best”

-

Generous welcome-bonus offers (e.g., large number of points or miles for initial spending). SUPREMARINE

-

Robust rewards structure (points/miles on travel, dining, everyday purchases).

-

Travel-friendly perks: airport lounge access, airline/hotel elite status, travel insurance, no foreign transaction fees.

-

Flexible redemption options (transfer partners, wide use of points).

-

Reasonable annual fee relative to benefits (some cards with higher fees may be justified if benefits are high). For 2025, guides classify cards by category (no annual fee, moderate fee, premium fee) to find the best travel credit cards. Kiplinger+1

How to pick the best travel credit card for you

-

Determine how often you travel and what style (budget vs luxury).

-

Assess your spending patterns (travel, dining, everyday purchases).

-

Consider your willingness to pay annual fee vs benefit value.

-

Check redemption flexibility and partner programmes (airlines, hotels).

-

Read terms carefully: sometimes the biggest bonus comes with significant spending requirement or limited redemption flexibility.

-

Use ranking/guide sites (The Points Guy, NerdWallet, Kiplinger) to compare top travel credit cards in the USA. NerdWallet

Final thought

For frequent travellers or those looking to upgrade their travel experience, the best travel credit cards USA offers can generate value far beyond the annual fee—if used strategically. Choose a card that aligns with your travel style and spend habits, and use the card to maximise benefits, not just signage.

Conclusion

In this article we’ve covered five distinct but related financial-decision topics, each with the unique phrase you requested:

-

“ranking personal loans USA” – how to evaluate and compare personal loans in the U.S.

-

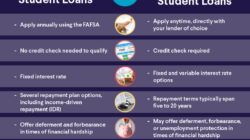

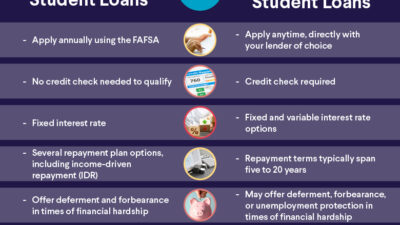

“premium student loans” – high-quality student-loan options with superior terms.

-

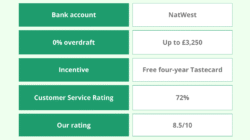

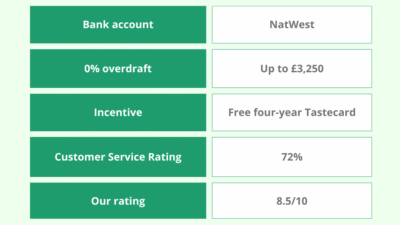

“buy bank account comparison UK” – how to compare and select bank accounts in the UK as if purchasing the best fit.

-

“top student loans” – the best student-loan programmes to consider (especially in the U.S.).

-

“best travel credit cards USA” – how to choose travel-rewarding credit cards in the U.S.

Although each topic is different (personal loans vs student loans vs bank accounts vs credit cards), they share a common theme: making an informed, strategic financial choice rather than simply accepting the default. Whether you’re borrowing, choosing where to bank, or selecting a credit card for travel, approaching the decision with a comparison mindset—and using trusted rankings or guides—makes a big difference.