Another major financial topic is the idea of premium student loans. While “premium” might suggest luxury or high cost, in this context it refers to student-loan products that offer superior features, better terms, or enhanced benefits—often targeted at borrowers with strong credit, or graduate/professional students.

What constitutes a “premium student loan”

-

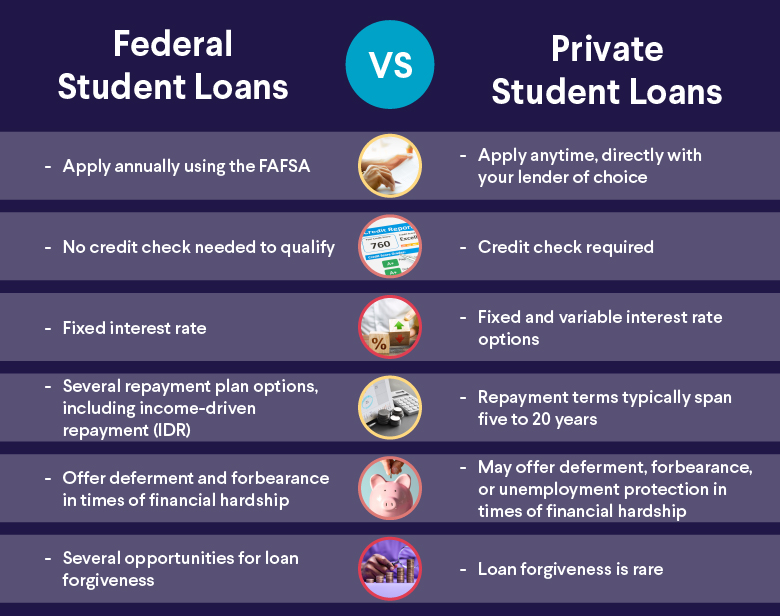

Lower interest rates than typical private student loans (for example, fixed APR at the very low end of the range). According to comparison sites, fixed-rate private student loans can range from about 2.85 % up to 17.99 % APR for the most creditworthy borrowers. credible.com+1

-

Flexible repayment options (interest-only periods, grace periods, deferred payments).

-

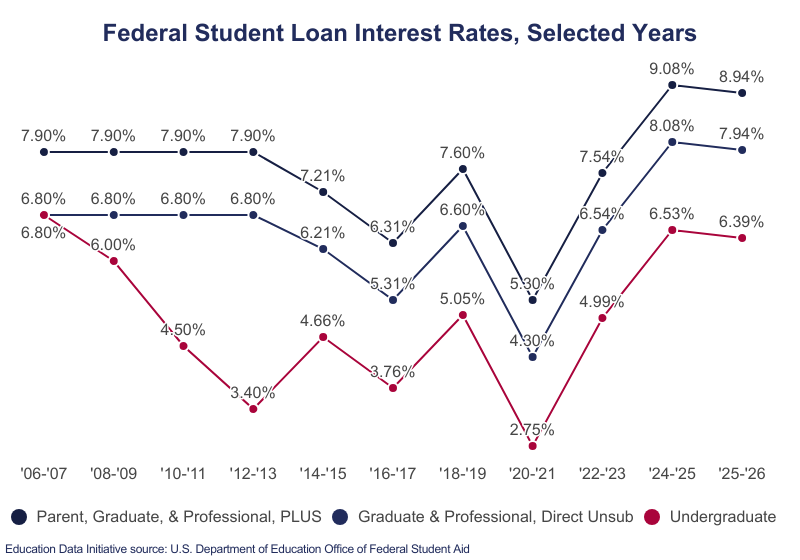

No or minimal origination fees or hidden charges.

-

Co-signer release options for future flexibility.

-

Added perks like loyalty discounts, autopay discounts, or rate reductions for strong performance.

How to decide if a premium student loan makes sense

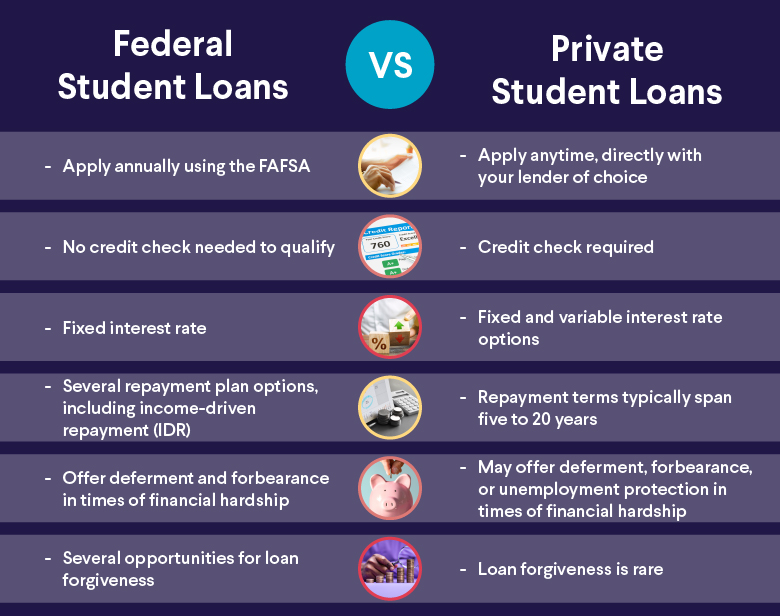

If you are a borrower with a strong academic and credit background and you expect good post-graduation earnings, taking on a “premium student loan” may be a good decision—especially if you need funds beyond what federal student loans provide. Keep in mind, however: federal student-loan programs often offer better borrower protections, so those are usually the first choice. studentaid.gov

Risks and caveats

-

Even premium loans are still debt; you will need to have a solid plan for repayment.

-

Some premium features may raise costs (for example extended grace period might increase total interest cost).

-

You must read the contract carefully: what happens if you don’t meet the requirements (graduation, job placement)?

-

Be sure to compare different lenders—just because it’s labelled “premium” doesn’t make it best for you.

Final thought

If you qualify for a premium student loan, it can provide advantageous terms and flexibility—but the key is aligning the loan with your education and career plan. A “premium” label is helpful but not a substitute for careful comparison and strategic borrowing.