When navigating the financial space of borrowing, many Americans are asking: where do I begin in the task of ranking personal loans USA? The term captures the idea of comparing and ordering the many different personal-loan offers available in the United States by quality, cost, features, accessibility—and then choosing the one most appropriate to your circumstances.

Why rankings matter

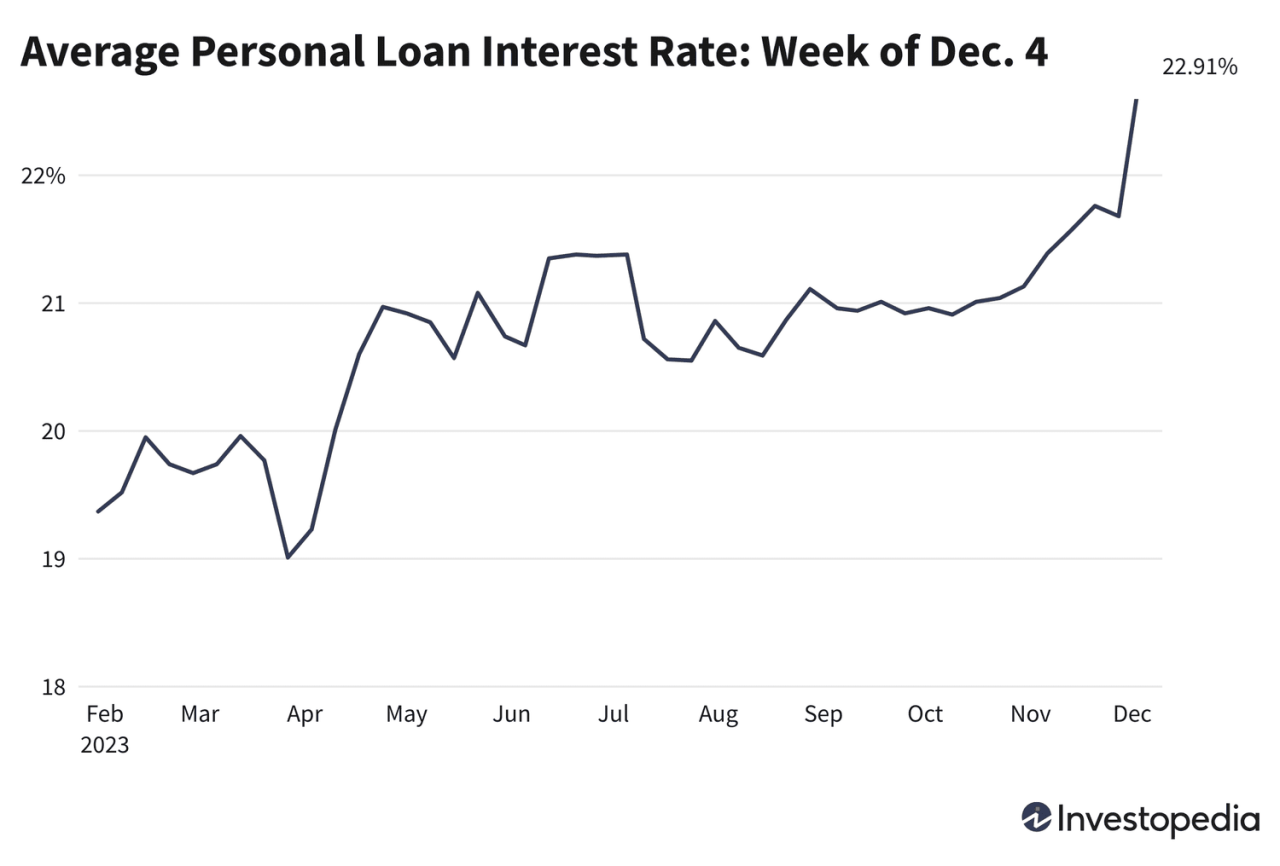

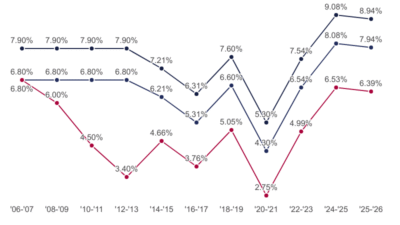

Because a personal loan is often unsecured and used for major decisions (debt consolidation, large purchases, emergencies), selecting wisely is crucial. Resources such as NerdWallet show that personal-loan APRs (annual percentage rates) for qualified borrowers in 2025 can start as low as about 7 % and go significantly higher depending on credit profile. credible.com+3NerdWallet+3Bankrate+3 Lists and rankings help you filter out lenders that are overpriced, inflexible, or have poor terms.

Key criteria for the ranking

When you see a “ranking personal loans USA” list, the best ones will evaluate:

-

Interest rate / APR — Lower is better, but watch for hidden fees. credible.com

-

Term length & monthly payment — The comfortable monthly amount and loan duration matter.

-

Fees and penalties — Origination fees, pre-payment penalties, late-fees.

-

Ease of application & funding speed — Some online lenders offer faster disbursement than traditional banks. axosbank.com

-

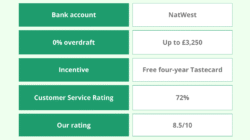

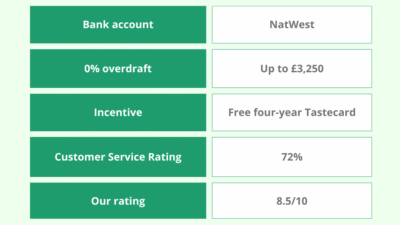

Customer service & transparency — LendingTree’s review of banks found that accessibility, low barriers and customer experience make a difference. LendingTree

-

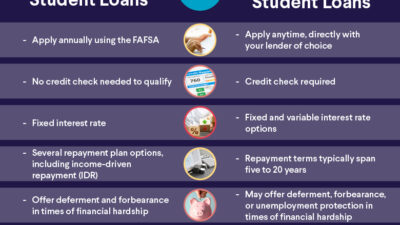

Eligibility & credit-score demands — Some loans are aimed at borrowers with strong credit; others cater to fair or poor credit but at higher cost. experian.com

How to use a ranking list

-

Start by identifying your credit profile (excellent, good, fair) and your borrowing need (amount, purpose).

-

Look up ranking lists such as “Best Personal Loans USA” and filter for your profile. For example, one list mentions lenders like LightStream, SoFi, and Upgrade as among top-recommended. Investopedia+2Forbes+2

-

Always pre-qualify if the lender offers it (so you can see an estimate of your rate without affecting your credit score) and compare at least a few offers side by side.

-

Consider the total cost (interest + fees) rather than only the monthly payment.

-

Read the fine print: e.g., what happens if you pay early, or if you default?

Final thought

By using a thoughtful approach to ranking personal loans USA, you give yourself the best chance of choosing a loan that supports your financial goals rather than undermining them. The ranking lists are not infallible—but they provide a credible starting point for comparison, saving you from countless hours digging through dozens of lender websites.